Disruption: Survey insights

The approach

At the start of this project, we identified a population of 165+ CAEs who we were keen to engage with via roundtables and a survey we circulated. We sent our disruption survey to those who were unable to join our roundtable discussion and received a total of 50 responses.

The results

Of those who responded, 24% hail from the private sector, 30% from the public sector and 38% from financial services. The remaining 8% come from other sectors. These results have been sub-divided into three graphs: private sector, public sector and financial services. All of which can be found below.

As this is a disruption project, it was interesting to note that whilst 72% of respondents said that they had been disrupted, a noticeable 26% said they hadn’t, with 2% responding as ‘unsure’ as to whether their organisations had been disrupted through the pandemic.

The survey asked respondents to rate the following sources of disruption in priority order

- People – recruitment, retention, talent and wellbeing

- Technology – information security in the expanded work environment, AI, robotics and machine learning

- Pandemic – exacerbated key risks and lessons from the pandemic

- Perfect storm assurance provision – climate change, social tensions and unprecedented economic volatility

- Cultural drivers – organisational culture, people and wellbeing

- Operational and financial resilience (capital stability and liquidity) and liquidity

- Exploitation of operational and economic disruption – Brexit, political uncertainty and fraud

- Supply chain disruption and vendor solvency

- Brand and reputation of their businesses

- Lessons Learnt (disaster and crisis preparedness) state of readiness.

- Mergers and acquisition

The charts below detail how respondents from each sector prioritise the list. The prioritsation is perhaps unsurprising: the pandemic has been a disruptor across all sectors and across all geographical locations. Whereas cultural drivers, technology, culture and people are linked very closely to the specific sectors.

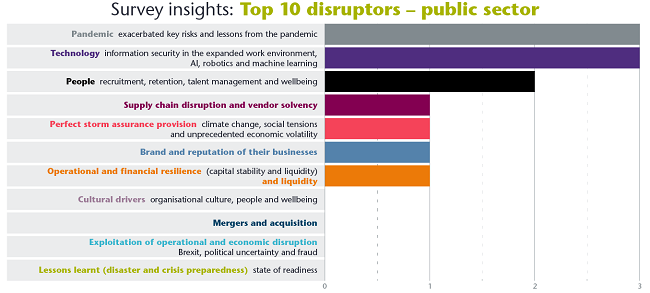

Top 10 disruptors – public sector

In the public sector, the main priorities for respondents are the pandemic, technology and, in third place, people - including recruitment, retention, talent management and wellbeing. These results are perhaps not surprising given the challenges in the sector and its focus on people culture. Wellbeing was identified as high on their priorities, although,as is highlighted in our disruption case studies, mental health and general wellbeing have been a consistent focus for all sectors (public, private and FS).

*Click thumbnail to enlarge graph.

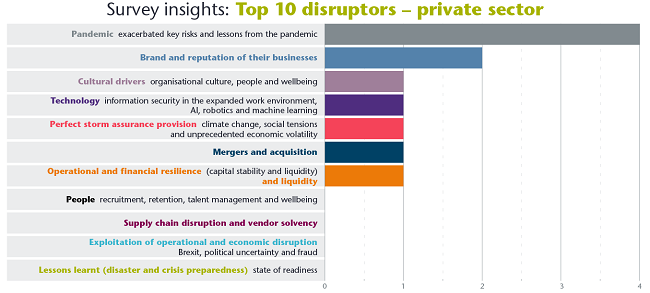

Top 10 disruptors – private sector

In the private sector, the main priorities are the pandemic, followed by brand and reputation. It is perhaps reasonable to speculate that apart from the pandemic, a key disruptor would be brand and reputation. Customers are often the key driver and reliance on a brand and reputation has an impact on the sustainability of businesses in this sector.

*Click thumbnail to enlarge graph.

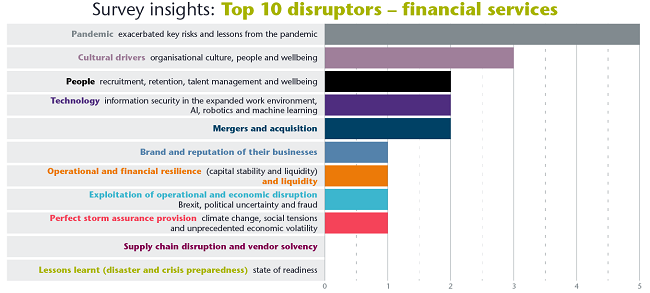

Top 10 disruptors – financial services

As you can see, in the financial services sector the leading priorities are the pandemic and cultural drivers. It might be reasonable to assume that perhaps the second priority was cultural drivers because for the majority of employees in the financial services sector (for example frontline, traders, etc) remote working wasn’t a common occurrence. The impact of culture on a remote working environment was perceived to be a key disruptor as organisations worked through the pandemic.

*Click thumbnail to enlarge graph.

Supporting research

As part of the survey, we also asked respondents the following questions:

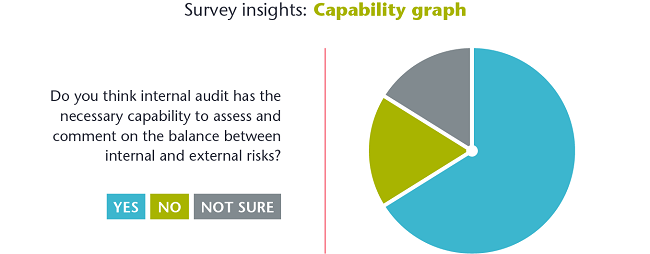

- The world is riskier and organisations are forced to take more risks to survive.Therefore, capability, capacity and technology are now key requirements for organisations including internal audit. Do you think that internal audit has the necessary capability to assess and comment on the balance between internal and external risks analysis?

- And, if so, to what extent would this capability inform their contribution to the impact of future disruption events (e.g. climate change, financial liquidity, cybersecurity, and organisation sustainability)?

*Click thumbnail to enlarge graph.

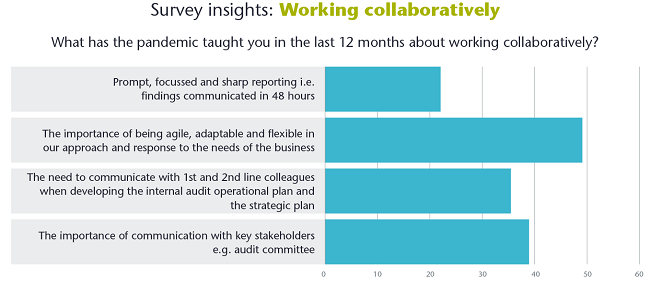

At the start of the pandemic, in April 2020, we introduced a HIA Virtual Forum which ran weekly for some months, with CAEs/HIAs sharing experiences and opportunities presented by the pandemic in terms of it being a disruptor for internal audit as well as for organisations. As we moved into autumn 2020, the forum changed to monthly. In July, we also introduced a Local Authority Internal Audit Virtual Forum. One of the constant topics for both was learnings from the pandemic – and how we can take these forward. Following the release of the new Three Lines Model - and the importance it places on collaboration, communication and coordination between the 1st, 2nd and 3rd lines - we thought it would be interesting to understand what as a profession we had learned.

*Click thumbnail to enlarge graph.

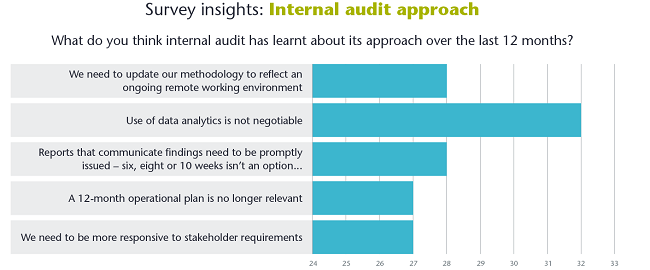

We also wondered based shared experiences and the findings of our Q&A sessions at webinars, whether internal auditors may have learned about its approach and perhaps what they may do differently.

*Click thumbnail to enlarge graph.

Of particular relevance, was the recognition that the use of data analytics is not negotiable. To support members, we have created a Data Analytics Working Group. If you are interested in joining the group, please contact its organiser reach out to Derek Jamieson on email at derek.jamieson@iia.org.uk.

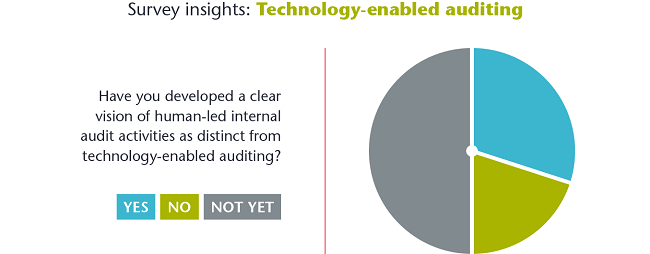

The final question we asked in the survey related to the use of intelligent controls methodology to inform internal audit planning to mitigate disruption risk and whether the respondents had considered this when developing their internal audit plans.

*Click thumbnail to enlarge graph.

Closing thoughts

McKinsey, in their article ‘Building the internal-audit function of the future’, identified that the primary role of internal audit functions is to help decision makers protect organisational assets and reputations, as well as to support operational sustainability—functions that have come under increasing pressure over the past year.

With the COVID-19 pandemic leading to a sharp rise in home-based working, asset risks have increased, while a disrupted business environment has fuelled uncertainty around reputations and sustainability.

Over the coming year, the challenge for internal audit functions will be to ensure that they continue to provide secure oversight while adapting to a dynamic risk landscape.